There are only so many ways that a business can make more money. Put simplistically, it can sell more stuff, sell stuff to more people or charge more for the stuff it sells. We help our clients do all three. But recently, we’ve noticed a shift in the last of these strategies – charge more for stuff – that means businesses need to think differently.

A tough time for premium products

We regularly work with brands to help them understand what it takes to be a premium brand and how to develop and market products that command a premium price. However, our clients have started to ask us a different question. Instead of “How can we charge more for our products?”, we are hearing “How can we justify – and defend – our premium product’s existing price point?”

So, why the shift? Premium products are feeling the effects of the current cost-of-living crisis. When times are tough, consumers use a variety of strategies to cope. If you are accustomed to buying locally-sourced, organic cheese with sourdough crispbreads to go with your artisanal, small-distillery gin and tonic, what do you do to save money? Do you swap for a cheaper brand’s cheese or crackers with mid-market gin? Supermarket own labels? Or do you – heaven forfend – go without your after-work drink and nibbles entirely?

According to the Office for National Statistics, the price of food and non-alcoholic beverages rose by 17.4% in the year to June 2023. Although this is slightly down from 18.4% in May, prices are still high, and this is having a big impact on people’s lives. Research by Kantar shows that nearly 70% of households are either ‘extremely’ or ‘very worried’ about food and drink inflation compared to just over two thirds when asked the same question in January. The company estimates that at the current level of inflation, if people don’t change how they shop, households will spend £683 more on their annual grocery bill.

So, of course, people are changing how they shop. Another study, by Pricer, shows that 92% of UK shoppers say they are now price conscious; this is up 33 percentage points since 2021. It also shows that over two thirds (68%) of consumers say they have switched from branded goods to supermarket own label and three fifths (61%) have switched some of their shop to discounters such as Aldi and Lidl. Brands are seeing this reflected in falling scores for the brand-tracking metric ‘worth paying more for’. And the savings are significant; Kantar estimates that by seeking out cheaper deals and retailers, customers have limited the annual bill rise to just £330.

Meaningfully different, not just reassuringly expensive

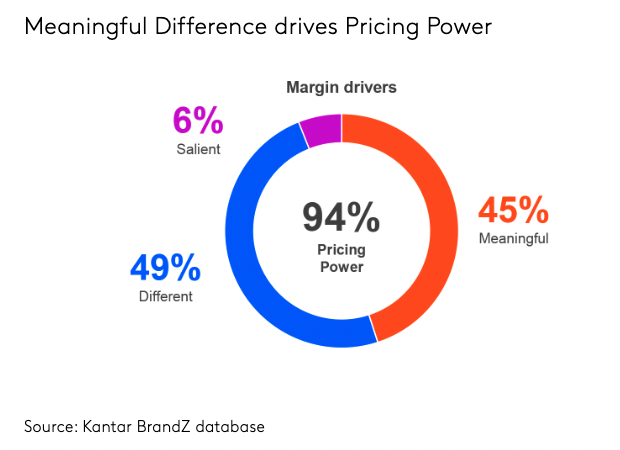

Pricing can stand as a proxy for quality, as the long-running Stella Artois campaign demonstrated. But it’s probably not a coincidence that the lager brand dropped the ‘reassuringly expensive’ tagline at the beginning of the last financial crisis in 2007. For consumers to believe that a brand is worth paying more for, they need to feel it is what Kantar’s Brand Z calls ‘meaningfully different’ from other products, on a dimension that they care about; the product needs to meet consumer needs in relevant ways, form emotional bonds and play a valuable role in their lives.

For brands, the holy grail is to be so well differentiated that no substitute for your product exists, leading to price inelasticity of demand – the same volume of consumers will buy your product even if prices rise. Price inelasticity is associated with products that are so necessary that people can’t do without them, such as petrol or electricity, or so desirable that people get benefits over and above the functional, such as luxury designer labels that convey status and, theoretically, taste.

However, even in these categories, nothing is entirely inelastic. People will buy less fuel-hungry cars and take to their bikes as petrol prices rise, and the success of resale sites such as Vinted show that people will find other, cheaper (and more sustainable) ways to scratch the designer-brands itch.

Brands that want to justify their pricing must find these meaningful points of difference and, crucially, convey them to customers.

What is the alternative?

Given the cost-of-living threat, there is a temptation to lower prices to retain market share while the crisis bites. But this can end up in a race to the bottom, with your brand getting stuck in an endless cycle of discounting and promotions, which will ultimately damage the brand and make it impossible to re-position as ‘worth paying more for’ again when the economy improves.

Mark Ritson calls price promotion “the crack cocaine of promotional activity” because it seems to work initially – if you measure success purely on the basis of unit sales. But, because all you are doing is pulling forward sales to existing customers who are buying sooner or in bulk during the promotion, you create a later demand problem which, because it worked previously, you try to address with further price promotion… and so on, ad infinitum.

“Eventually”, Ritson says, “brands reach a rock bottom where promotional pricing becomes the norm…. Many organisations then begin to cut quality, because their RRP is now nothing more than a bluff and their average selling price, many percentage points lower, now demands a lesser quality of construction for any profit to be possible.”

How to stay ‘worth paying more for’

When we help brands to justify their pricing, our first step is to explore the rules for premium pricing in their specific category. We then work with them to understand how they can exploit the rules to differentiate from competitors and to communicate those points of difference effectively to consumers.

The process is as follows:

Step one: understand and leverage the rules for ‘worth paying more for’

We start by conducting an audit of other brands in the category and exploring the factors that could be leveraged as differentiators.

Determine your actual competitor set

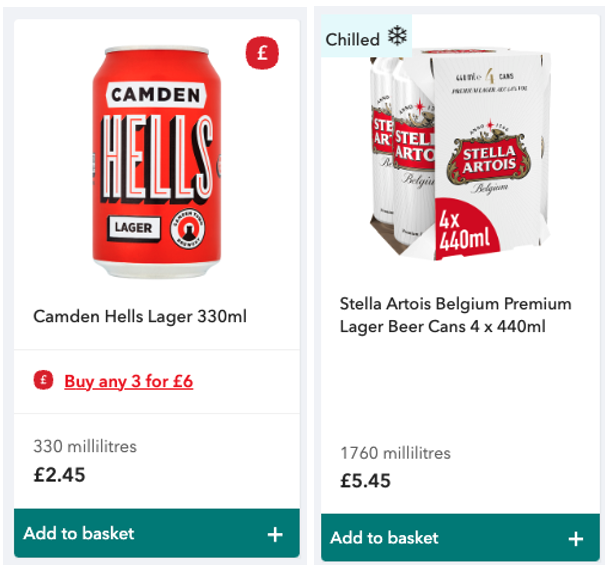

Because consumers are changing how they shop, it is important to understand which competitors are truly in the consideration set for your customers, so we can define the boundaries of the category. This has become more fluid in the cost-of-living crisis. If we use beer as an example, a can of Camden Hells Lager is £2.45 at the Coop, but you can buy a four-pack of Stella Artois in larger cans for just £5.45. In a recessionary environment, there is only so far someone looking for flavoursome ‘craft’ lager will go before considering alternatives. Consumers will increasingly be making these comparisons so it is important to resist the temptation to fixate on manufacturer-centric categories or sub-categories.

Intrinsic vs extrinsic differentiators

Intrinsic factors are the tangible features of the product itself, such as the ingredients, manufacturing process or packaging. For example, is your coffee single-origin or is it a blend of unspecified beans? Is the packaging a beautifully designed paper pouch or a plain glass jar?

Extrinsic factors are harder to leverage but can be key to differentiation. These are the intangibles such as brand personality or emotional connections.

Understand which are the hygiene factors

Once we have compiled a list of features that are relevant in your category, the next step is to understand which of these can truly differentiate (points of differentiation) and which are purely ‘table stakes’ (points of parity), without which you aren’t even in the running. For example, if your chocolate isn’t wrapped in foil and paper, it isn’t premium.

Decide on key differentiator for your product

Finally, once the audit is in and the analysis done, you can start to work on how to differentiate your product. You are looking for attributes that fit with the overall rules of what makes something premium in your category, that you can achieve in production and that will make it hard for a competitor to replicate. For example, by dialling up Italian provenance to hero their natural Italian ingredients, San Pellegrino have carved out an ownable position in premium soft drinks that is difficult to imitate without looking like a copycat.

Step two: focus marketing relentlessly around that differentiator

It’s not enough to decide on a differentiator and then go on marketing the product in the same way as before. Everything must be focused on that differentiator if consumers are to see you as worth paying more for. This involves adjusting all messaging to highlight the point of difference and ensuring that your positioning is razor sharp.

Summary: when it comes to the crunch, will consumers pay more?

At Advertising Week Europe, earlier this year, Dan Winslet from KP Snacks shared a case-study about Tyrrell’s potato crisps. It was well-covered in the marketing press at the time. The story goes that in 2018, Tyrrell’s was losing out to closest rival, Kettle, despite winning in taste tests. Consumers were just not willing to pay Tyrrells’ premium price, leading to the sort of destructive discounting loop described above. Winslet described the ‘squeaky bum moment’ when they decided to stop discounting, raise the price and invest in brand building; initially, sales plummeted.

But the marketing team had identified a meaningful and valuable point of difference: Tyrrells’ idiosyncratic English character. They built upon this by creating quirky flavours and launching the ‘Tyrrellbly Tasty’ brand platform. This resulted in a 40% increase in sales value in the year to December 2021. The investment in differentiating the brand had convinced consumers it was worth paying more for.